Market IQ Financial | Integrated Market and Risk Surveillance Feeds

Learn about Market IQ Financial's actionable market intelligence feeds - including how to link vendors and understand key metrics.

![]() Estimated Read Time: 6 minutes

Estimated Read Time: 6 minutes

Sections in this article:

- Add Market IQ Financial to a Vendor

- Understanding Market IQ Financial Metrics

- Remove a Linked Market IQ Vendor

- International Business Credit Checks

Note: For an introduction to Market IQ Financial, see the Market IQ Suite.

Add Market IQ Financial to a Vendor

To add Market IQ Financial to an existing vendor:

- Navigate to the vendor record, then click the Market IQ tab.

- From the Market IQ Financial section, click Connect.

- Enter the details for the vendor, then click Find. If no results are found, ensure the vendor details are correct and search again.

- Review the Company Name and information from the list of results, then click Apply. A confidence score is returned in the case of multiple results.

The Market IQ Financial metrics are now available:

Understanding Market IQ Financial Metrics

Market IQ's financial metrics give you an instant financial overview of a company, allowing you to verify existing or potential vendors with confidence, and ensure they are financially stable and trustworthy. It gives you peace of mind before entering any legally binding business agreements. To help you assess a company’s financial stability, Market IQ provides key metrics based on verified financial data:

- Credit Rating

A company credit rating, or business credit score, shows the likelihood of a company becoming insolvent within the next 12 months. It uses an A–E International Score to help you compare credit risk across countries.

Note: The company credit rating is calculated using advanced statistical algorithms that consider over 150 parameters, including economic and industry factors. Credit data is sourced from more than 200 providers, including official registries like Companies House in the UK. This ensures the information remains current and reliable.

- Credit Rating Description

A descriptive rating as shown in the below table, that corresponds to the Credit Rating score:

Credit Rating Credit Rate Description A Very Low Risk B Low Risk C Moderate Risk D High Risk E Very High Risk - Credit Limit

The credit limit is the recommended total amount of credit that should be outstanding at any one time. It is calculated using the company's Risk Weighting, and key balance sheet data for those that file accounts, or other non-financial information for those that do not.

The maximum credit limit for companies is determined as follows:

- For a Public Limited Company (PLC) scored 30 and above: $50m

- For a non-PLC company scored 30 and above: $1m

- For all companies scored below 30: $0

- Local Score

The local score provides a simple way to segment companies based on credit risk. It links the probability of insolvency to five scoring bands, each grounded in real-world failure statistics. This classification of credit risk does not rely on overall population percentages, but rather on the percentage of failures within the population.

- Historical Performance

The local credit score is shown over time, based on the historical data available for the vendor. This helps identify trends and supports informed decisions about vendor stability.

- Full Credit Report

The full Creditsafe report includes a wide range of company credit and financial performance metrics, depending on the vendor's country of registration. It is automatically updated when changes to Market IQ metrics are detected, and each version is saved as a PDF in the Market IQ folder within the Files tab of the vendor record.

This includes information such as:- Company Summary

- Credit information

- Company History

- Financial information (e.g. mortgage details, profit and loss statements, and balance sheet)

- Director and shareholder details

- Group structure

- Adverse information (e.g. County Court Judgements in the UK)

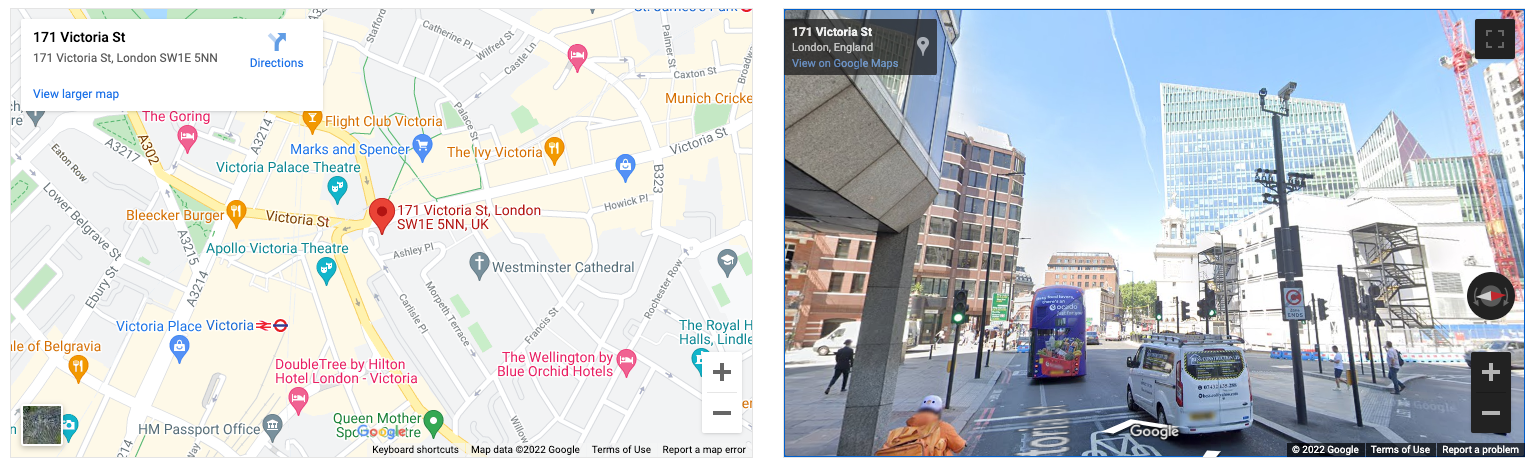

- Registered Address Location

A visual map and street view of the vendor's registered address.

Remove a Linked Market IQ Vendor

To remove a vendor linked to Market IQ Financial, either due to a mismatch or if you no longer wish to track their performance, expand the 3 dots on the Market IQ Financial section, then select Remove sync with Creditsafe.

International Business Credit Checks

Currently, Market IQ Financial gives you access to comprehensive financial and business information on companies from the following countries:

- Australia

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Japan

- Luxembourg

- Netherlands

- Norway

- Sweden

- United Kingdom

- United States of America