The Market IQ Suite

This article provides an overview of the Market IQ Suite and how it can enhance your vendor/risk management processes.

![]() Estimated Read Time: 8 minutes

Estimated Read Time: 8 minutes

Sections in this article:

Overview

Storing vendors and contracts in Gatekeeper helps manage legal obligations, budgets, and risks. However, vendor risk assessments often face three key challenges:

- Disparate data: Risk information is not centrally stored, limiting visibility across teams.

- Manual processes: Risk checks are completed across different systems, increasing admin effort and error risk.

- Static assessments: Reviews often happen only at onboarding or renewal, meaning new risks may go undetected.

Market IQ addresses these by providing financial health data, compliance checks, and cyber risk monitoring, centrally within your Gatekeeper vendor repository. With Market IQ, you can continuously monitor your vendors, automate risk alerts via workflows, and ensure compliance with various regulations. The Market IQ Suite includes:

- Market IQ Financial

- Market IQ Screen

- Market IQ Cyber

Additionally, Market IQ Lite is available on all Gatekeeper plans.

See the demonstration below to learn more:

Market IQ Financial 🏦

Market IQ Financial allows you to connect your vendors to the external Risk Assessment and Monitoring platform  Creditsafe, providing you with integrated credit and risk profiling directly in your Gatekeeper vendor repository.

Creditsafe, providing you with integrated credit and risk profiling directly in your Gatekeeper vendor repository.

With your vendors connected to Market IQ Financial, you can leverage the live market data to gain better risk insights, improve your vendor onboarding and risk assessments, and put your ongoing risk monitoring on autopilot, without having to leave Gatekeeper.

Vendor Onboarding 👨💼

Part of your Vendor Onboarding Due Diligence could include checking the financial health of a vendor and assessing any associated risk this presents to their operations, and yours.

With Market IQ Financial, you can connect your vendors to Creditsafe in Gatekeeper during a vendor onboarding workflow to:

- Access immediate summary data on the vendor’s financial risk

- Use this data to automate whether additional financial reviews and approvals are included

Watch the video below for a demonstration of this:

The Financial Risk Dashboard 📈

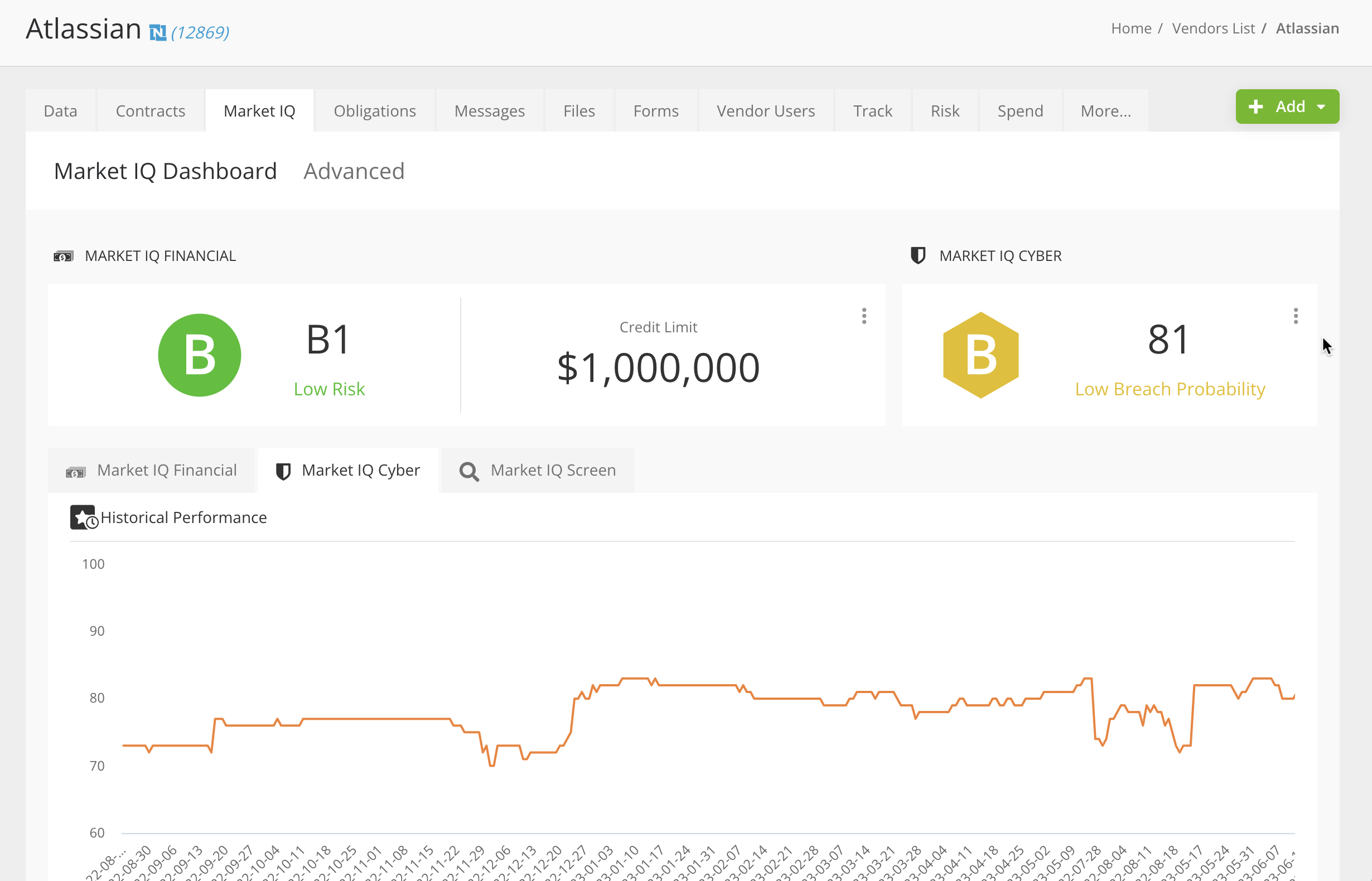

Once vendors are connected to Creditsafe, live summary data appears directly in their record and automatically updates when risk scores change. Each time you view a vendor’s dashboard, you’ll see the latest risk ratings.

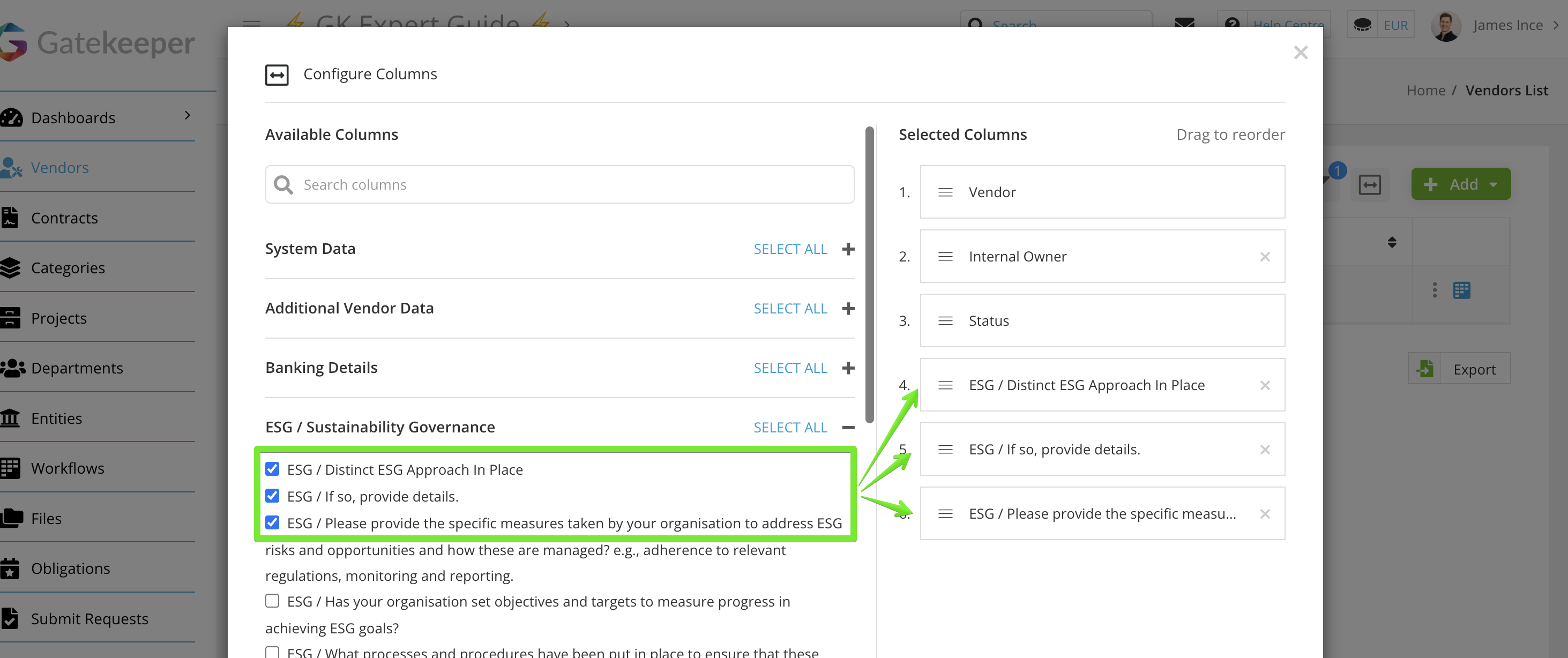

You can also leverage Saved Views to display data from Market IQ Financial as additional columns within the vendor list view.

Automate Ongoing Monitoring of Financial Risk ⚙️

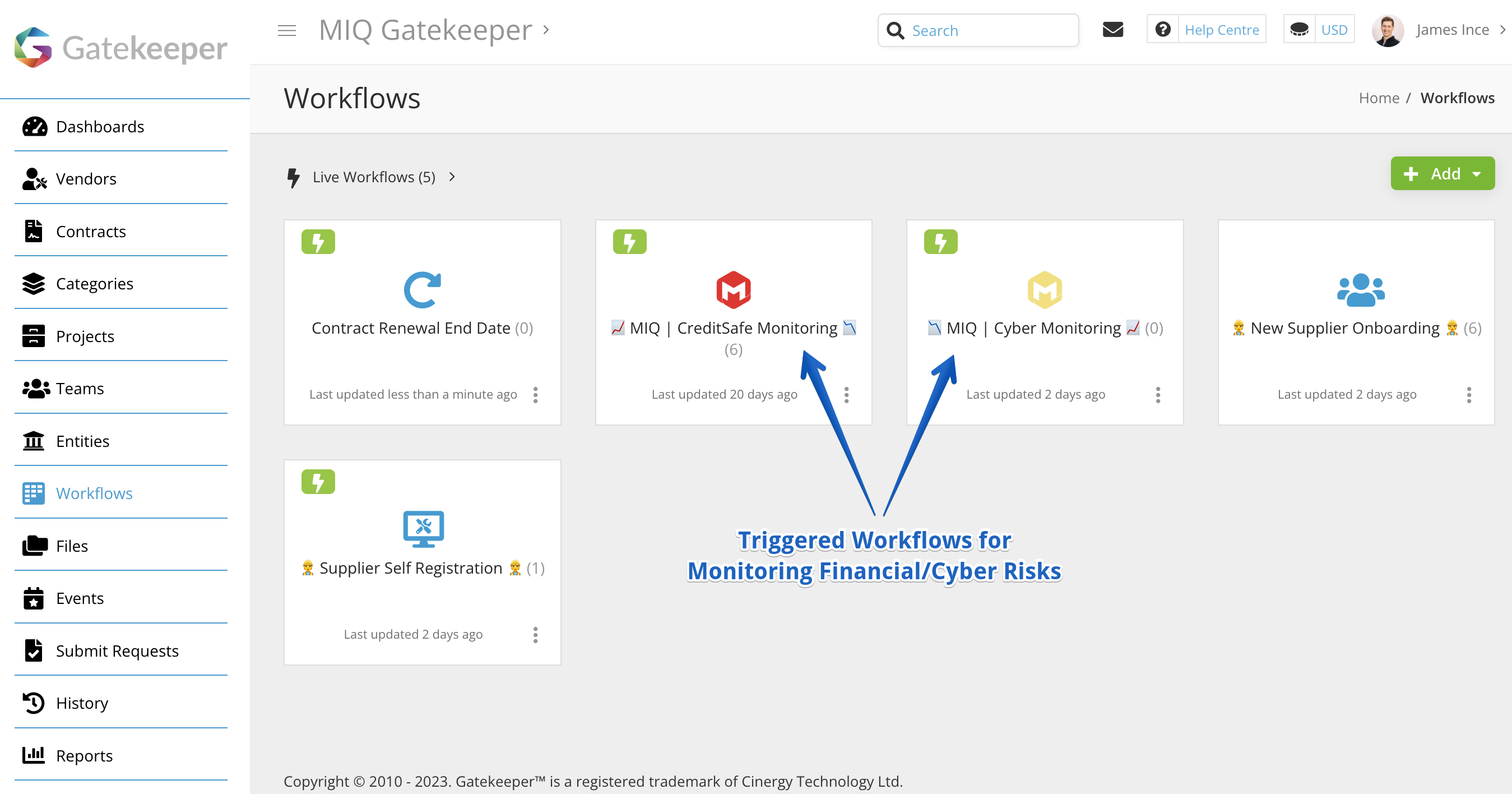

After completing initial vendor risk checks with Creditsafe data, you can set up a triggered workflow to monitor changes in a vendor’s risk level.

Watch the video below for a demonstration:

Follow-up Guides 📚

Market IQ Cyber 💻

Market IQ Cyber pulls data from  SecurityScorecard, the global leader in cybersecurity ratings, and the only service with over 12 million companies continuously rated. Gatekeeper pulls data from the SecurityScorecard platform, providing an A–F grade and 0–100 score to rate a company’s overall security across 10 key risk factors.

SecurityScorecard, the global leader in cybersecurity ratings, and the only service with over 12 million companies continuously rated. Gatekeeper pulls data from the SecurityScorecard platform, providing an A–F grade and 0–100 score to rate a company’s overall security across 10 key risk factors.

Vendor Onboarding and Due Diligence 🧑💻

You can use Market IQ Cyber to connect vendors to  Security Scorecard and include the Cyber Risk data in workflows. This data can drive conditional reviews and approvals, based on risk scores that meet your defined thresholds.

Security Scorecard and include the Cyber Risk data in workflows. This data can drive conditional reviews and approvals, based on risk scores that meet your defined thresholds.

The Cyber Risk Dashboard 📈

Once vendors are connected to Security Scorecard, live summary data appears directly in their record and automatically updates when risk scores change. Each time you view a vendor’s dashboard, you’ll see the latest risk ratings.

You can also leverage Saved Views to display data from Market IQ Cyber as additional columns within the vendor list view.

Automate Ongoing Monitoring of Cyber Risk ⚙️

Similar to the video walkthrough for Market IQ Financial, you can set up a triggered workflow to monitor changes in a vendor’s cybersecurity risk level using Market IQ Cyber.

Follow-up Guides 📚

Market IQ Screen ☑️

Market IQ Screen is another part of the Creditsafe integration - Creditsafe Protect. When connected for a vendor, it provides a link to the Creditsafe page where you can run compliance checks across risk categories such as:

- PEP

- Sanctions

- Financial Regulations

- Law enforcements

- Disqualified Directors

- Insolvencies

- Adverse media

Follow-up Guides 📚

ESG 🌳

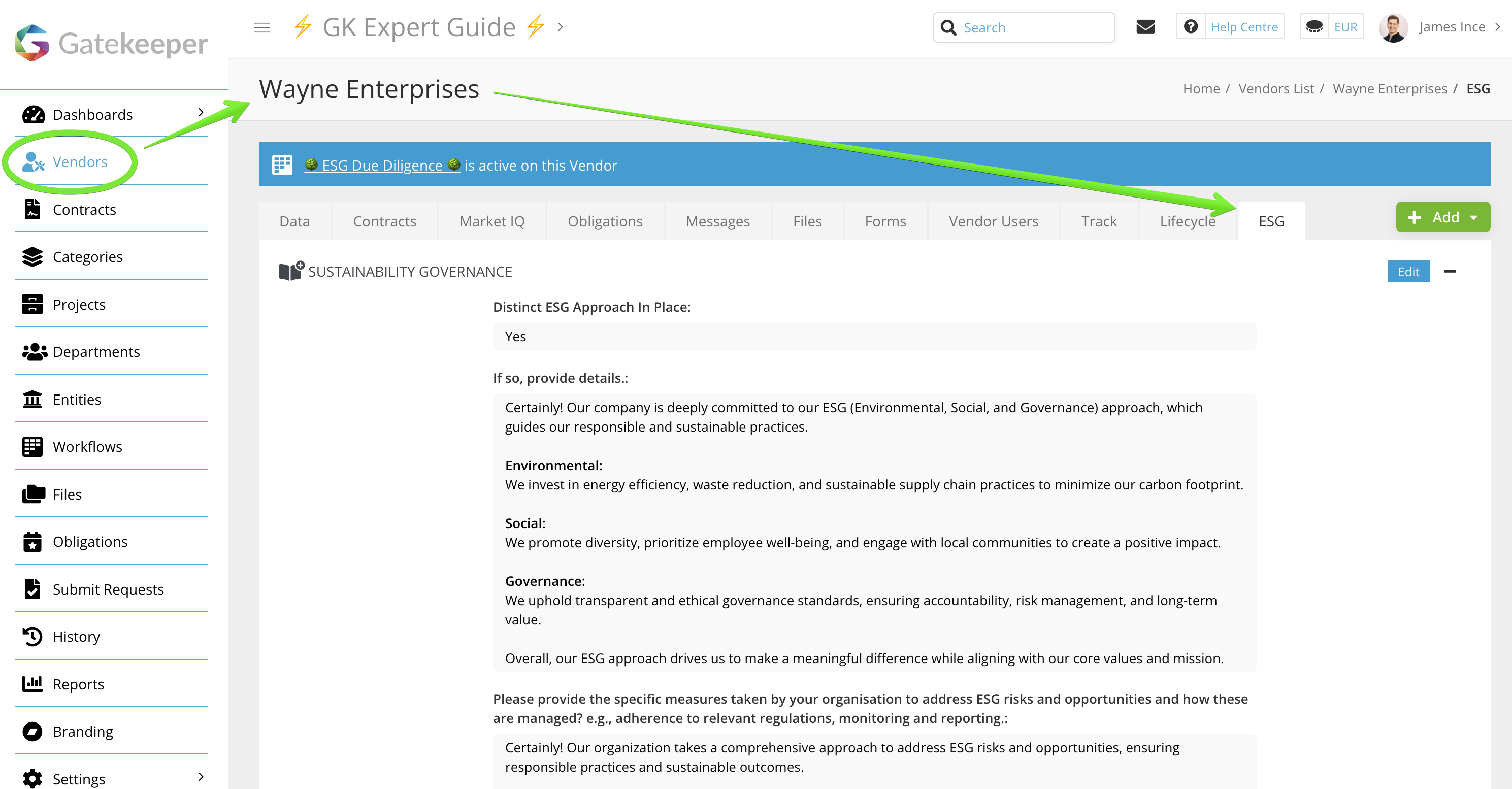

The ESG Due Diligence Assessment Best Practice Workflow is designed to run in parallel with your existing vendor onboarding and due diligence activities, allowing you to assess and track the environmental impact of your vendors. With this workflow in place, you will be able to report at scale the impact of your organisation's operations, as well as assess the importance being attributed to ESG by your vendors, including a performance-over-time consideration (with Smart Forms).

See the demonstration below to learn how you can collect key data and documentation from your vendors while completing your other necessary initial due diligence assessments:

It is possible to set up and organise the ESG data captured via the workflow form into a segmented tab within vendor records.

You can also view this across multiple vendors by creating a Saved View.

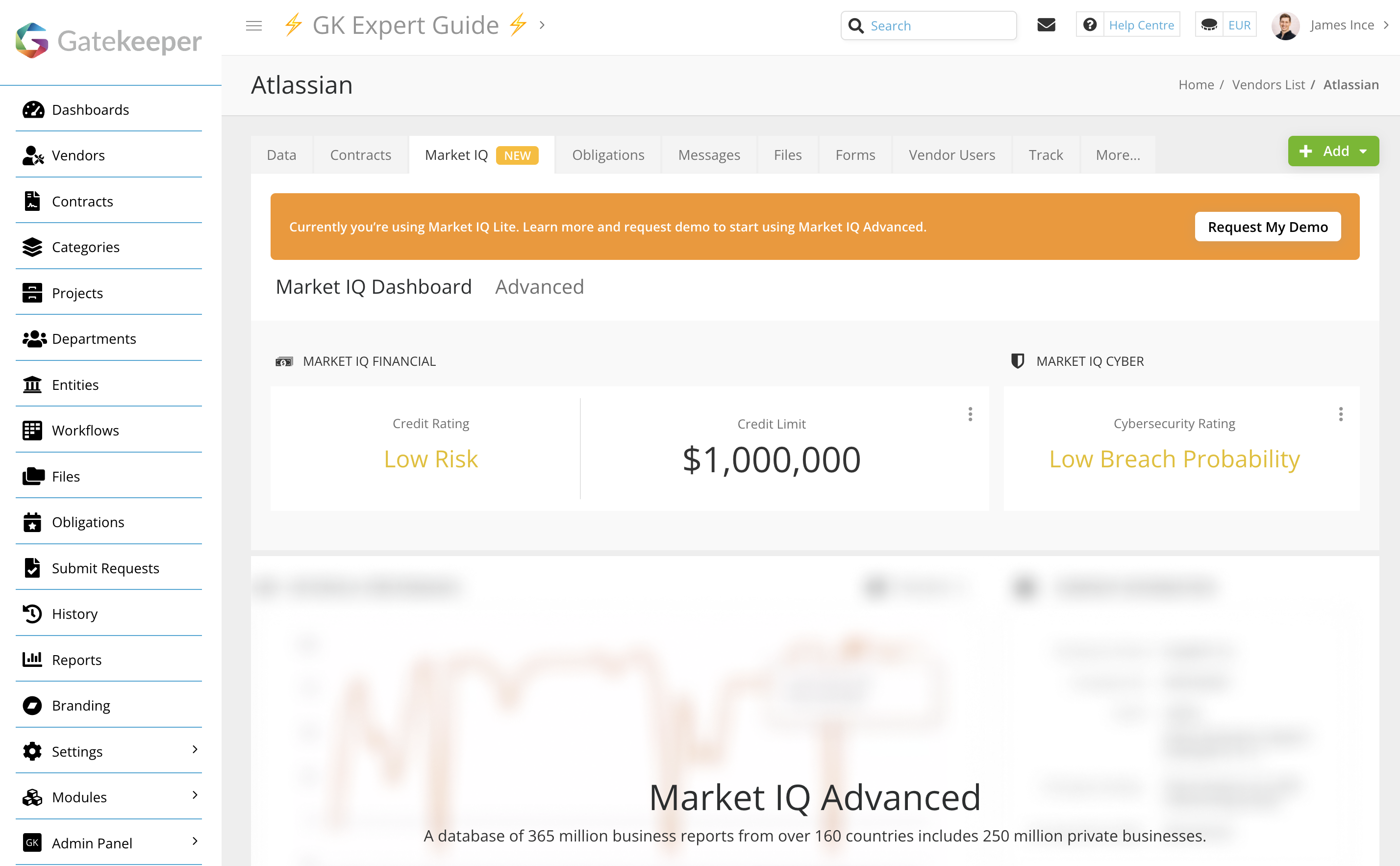

Market IQ Lite

The Lite version of Market IQ provides basic data from the Market IQ Financial and Cyber modules, available directly in your vendor records:

Financial:

Financial:

- Risk Description

- Credit Limit ($ Dollar Value)

Cyber:

Cyber:

- Risk Description

Gatekeeper automatically presents and updates these values for any vendor connected to Market IQ Lite. See the list below for a full description of what the Lite version includes and what it does not support:

- ✅ Visible in the Market IQ tab of vendor records

- ✅ Automatically updates with Creditsafe and SecurityScorecard changes

- ❌ Not available as columns in repository list views

- ❌ Cannot be used in workflow forms

- ❌ Cannot trigger workflow warnings or assessments

- ❌ Cannot be included in workflow notification emails

- ❌ Credit reports are not stored in the Files tab of vendor records